Welcome to my blog! This will be part one of a two-part report that includes a summary of Pendle and the protocols that are building on top of Pendle, dubbed the “Pendle Wars”.

Please share this newsletter if you think anyone else would benefit from reading it and feel free to share any thoughts with me about it at my Twitter @Khrippex. Enjoy!

Statistics:

Total Funding: $3.7M

Stage: Seed/Private

Investors: Mechanism Capital, Crypto.com Capital, Hashkey Capital, Spartan Group, CMS, imToken, DeFi Alliance, Lemniscap, LedgerPrime, Parataxis Capital, Strategic Round Capital, Signum Capital, Harvest Finance, Youbi Capital, Sora Ventures, D1 Ventures, Fisher8, Origin Capital, BitLink, Bitscale Capital, Hongbo (co-founder & CEO of DeBank), and Taiyang Zhang (co-founder & CEO of Ren Protocol).

Current Team Size: 12+

Location: Denver, Colorado / Southeast Asia (Hong Kong, Singapore, Vietnam)

Website: pendle.finance

History

Pendle first announced their protocol on March 8, 2021, with a rebrand from Benchmark to Pendle. Shortly after, they announced their protocol on Kovan Testnet on March 20, 2021, allowing users to test out the protocol by minting Ownership Tokens (OT) and Future Yield Tokens (XYT), now known as Principal Tokens (PT) and Yield Tokens (YT). After the testnet announcement, Pendle launched $PENDLE, their native and utility governance ERC-20 token on April 20, 2021, before launching their protocol on mainnet on June 17, 2021. The rest of 2021 saw Pendle develop partnerships with Sushiswap, Crypto.com, Rari, Olympus, Wonderland, Trader Joe, BENQI, and a key partnership with Avalanche that sparked Pendle’s first cross-chain move.

2022 saw some announcements from Pendle including its partnership with [Redacted] and a new project named “Project Permissionless” aimed at allowing anyone to create liquidity pools and provide liquidity through the protocol but the teams primary focus was Pendle V2. Pendle V2 was announced in three parts in November 2022 with the first part discussing a new V2 AMM mechanism that would minimize impermanent loss, slippage, and improve capital efficiency. The second part of Pendle V2 built on top of Project Permissionless with the Standardized Yield (SY) EIP-5115 token standard that would allow Pendle to wrap all ybTokens (yield-bearing token) into a single standardized yield interface. As a result, Pendle would become a truly permissionless platform that would allow anyone to create a pool for any ybToken. The third and last part of Pendle V2 was announced as $vePENDLE, an adaptation of Curve’s ve(3,3) vesting token model that would better align incentives to generate liquidity and fees for the protocol. Pendle developed a similar structure to Curve gauges; $vePENDLE lockers that only receive swap fees for the pools they voted for, setting the stage for part two of this report, the “Pendle Wars”. With the final announcement of Pendle V2 made on November 29, 2022, Pendle V2 was launched live on mainnet on Ethereum only.

Pendle closed out the year of 2022 with the launch of its ApeCoin ($APE) market, its ApeCoin compounder, and partnerships with Chainlink and KyberSwap to integrate Chainlink Automation and bootstrap additional $PENDLE liquidity.

Pendle in 2023 has been all about its expansion to Arbitrum. Pendle V1 was live on Ethereum and Avalanche but when Pendle V2 was launched, it was only live on Ethereum before going cross-chain to Arbitrum on March 2, 2023. Pendle made further integrations with the Arbitrum DeFi community after partnering with Camelot, a native Arbitrum decentralized exchange (DEX). On May 11, 2023, Pendle announced its first Pool 三 supporting the $PENDLE/$ETH pair on Camelot. The new Pool 三 means that liquidity would be channeled to the $PENDLE/$ETH pair on Camelot, creating deeper trading liquidity for all and generating more fees/rewards for liquidity providers. Further explanation about Pool 三 from the Pendle team can be read here and here.

About

Pendle is a DeFi protocol aiming to emulate the ~$490T TradFi interest rate derivatives market in crypto via their novel Standard Yield (SY) token that allows users to separate their yield-bearing Tokens (ybTokens) like stETH, cDAI, or yvUSDC, into Principal Tokens (PT) and Yield Tokens (YT). This allows users to execute different yield strategies that allow them to speculate or hedge against changing token yields and interest rates in various market conditions.

Long assets at a discount

Fixed yield for low-risk, stable growth

Long yield

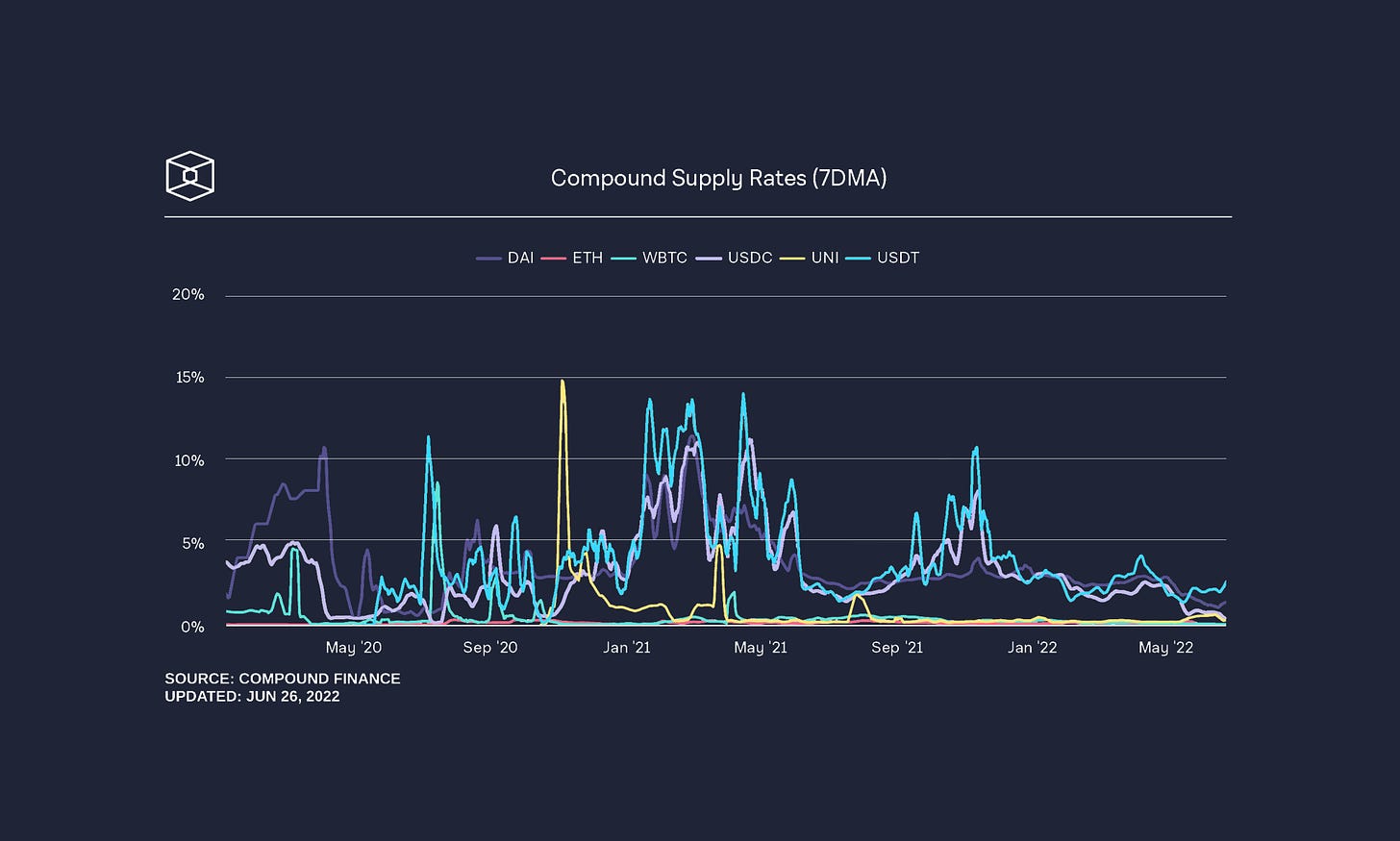

Token yields evidently fluctuate greatly, especially in different bull and bear market conditions:

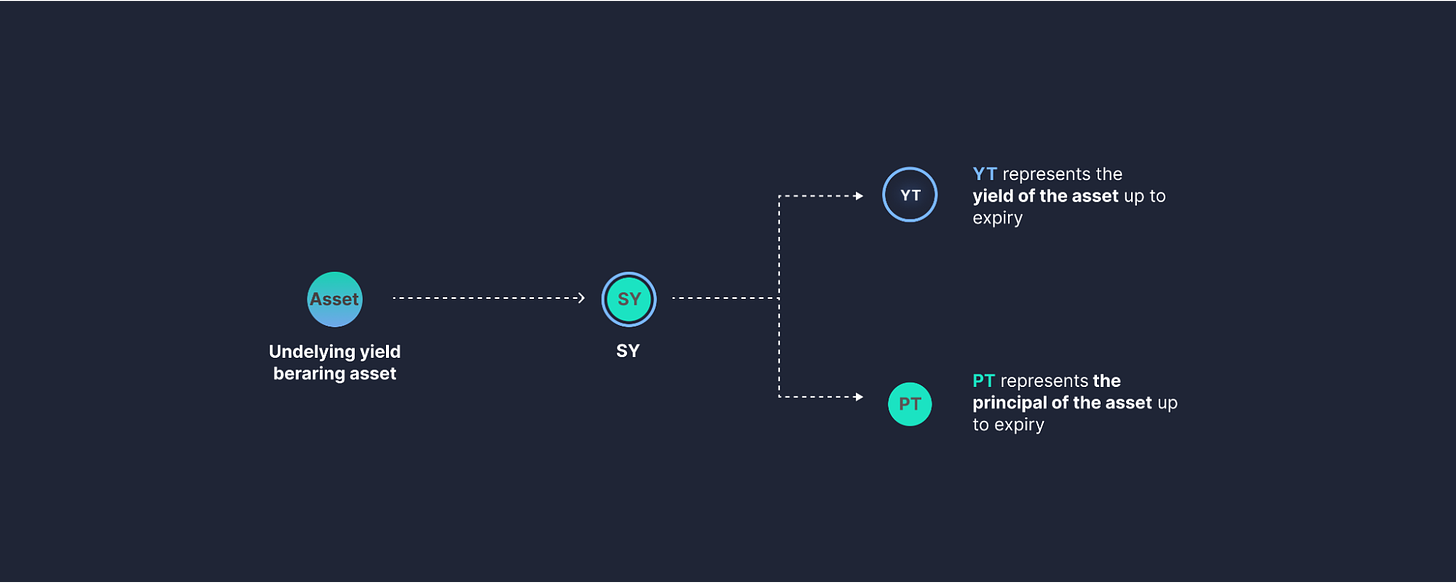

When users want to utilize Pendle’s platform, they must first wrap their ybTokens into a Standard Yield token standard that allows Pendle to implement a standardized API for ybTokens within a smart contract. This allows Pendle to standardize every ybToken’s yield-generating mechanisms.

Afterward wrapping the ybTokens into an SY token, ybTokens must be split up into two components, the Principal Token (PT) and the Yield Token (YT). An example of this can be shown with $stETH, Lido’s liquid staking token representing staked ETH. This would first be wrapped into SY-stETH before being split up into PT-stETH and TY-stETH.

The process of splitting a ybToken into PT and YT is similar to the process of bond stripping in traditional finance where the principal and interest payments of a bond are separated. In this, PTs are equivalent to zero-coupon bonds, while YTs are the detached coupon payments.

Principal Token (PT)

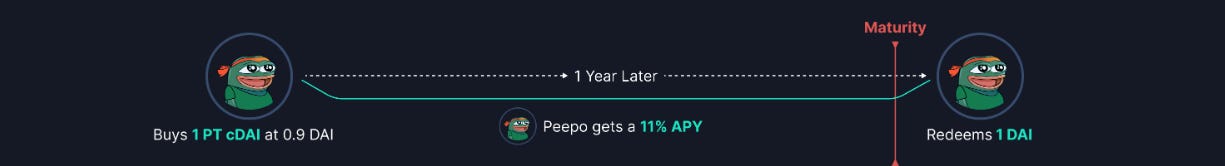

The Principal Token represents the principal portion of the underlying ybToken. Upon maturity, the PT can be redeemed 1:1 for the underlying asset.

e.g. 1 PT-stETH can be redeemed for 1 ETH worth of stETH at maturity.

When Pendle users purchase a PT, they are typically acquired at a discount compared to the underlying asset because of the time locked value. Assuming no swaps, the value of the PT will approach and ultimately match the value of underlying asset on maturity when redemption is enabled.

The known final value of the PT (relative to the underlying asset) is what establishes its Fixed Yield APY.

Yield Token (YT)

The Yield Token represents the yield components or the interest payments of the underlying ybToken. By holding a YT, the holder is entitled to receive the interest payments of the ybToken, earning what is represented as the “Underlying APY”.

e.g. holding 10 YT-stETH entitles you to receive the yield from 10 ETH deposited in Lido.

Buying YT allows users to "long" the yield of an asset and profit when the yield received is higher than the cost paid to buy YT.

After introducing the concept of bond stripping to crypto, Pendle devised a newly designed Automated Market Maker (AMM) Decentralized Exchange (DEX) in Pendle V2 specifically made for users to trade different yield products. In comparison to a typical AMM DEX with a fixed curve, Pendle’s exchange changes its curve to account for yield accrued over time and narrows PT’s price range as it approaches maturity. By concentrating liquidity into a narrow, meaningful range, the capital efficiency to trade yield is increased as PT approaches maturity. Pendle’s exchange also facilitates both PT and YT swaps using a single pool of liquidity. With a PT/SY pool, PT can be directly traded with SY, while YT trades are also possible via flash swaps.

PT/SY Swaps

Pendle V2 liquidity pools are set up as PT/SY (e.g. PT-aUSDC / SY-aUSDC) to allow for swapping between the SY and PT asset by considering the difference in price due to maturity.

YT Flash Swaps

YT can be traded via flash swaps due to the price relationship between PT and YT as expressed by: P(PT)+P(YT)=P(SY).

The relationship where the price of a YT is inversely correlated against the price of PT is used to utilize the PT/SY pool to swap for YT.

As PT and YT near maturity, PT increases in price because it gets closer to being redeemable 1:1 and YT decreases in price because there will be less interest payments left.

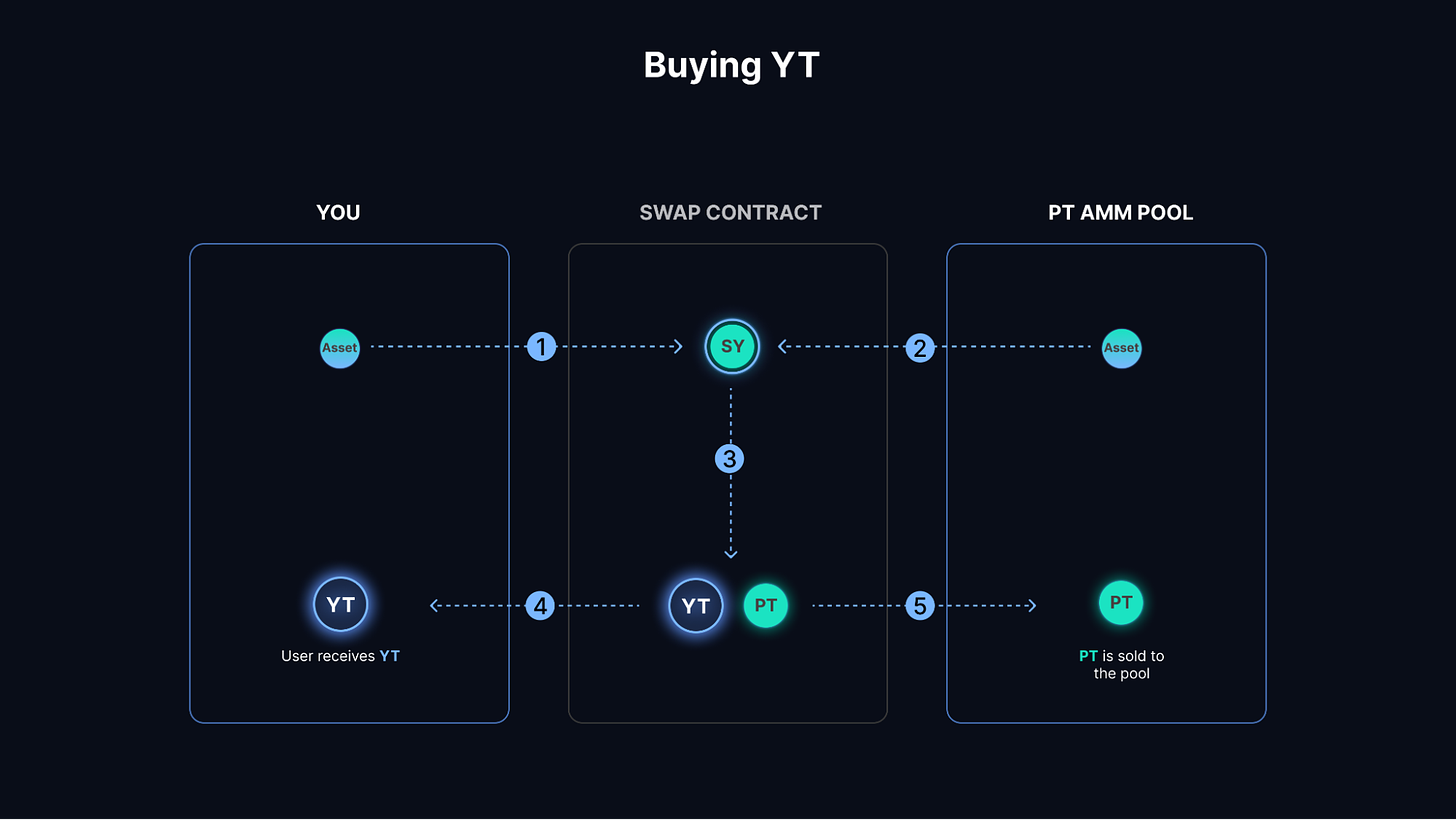

Buying YT

Buyer sends SY into the swap contract (auto-routed from any major token)

Contract withdraws more SY from the pool

Mint PTs and YTs from all of the SY

Send the YTs to the buyer

The PTs are sold for SY to return the amount from step 2

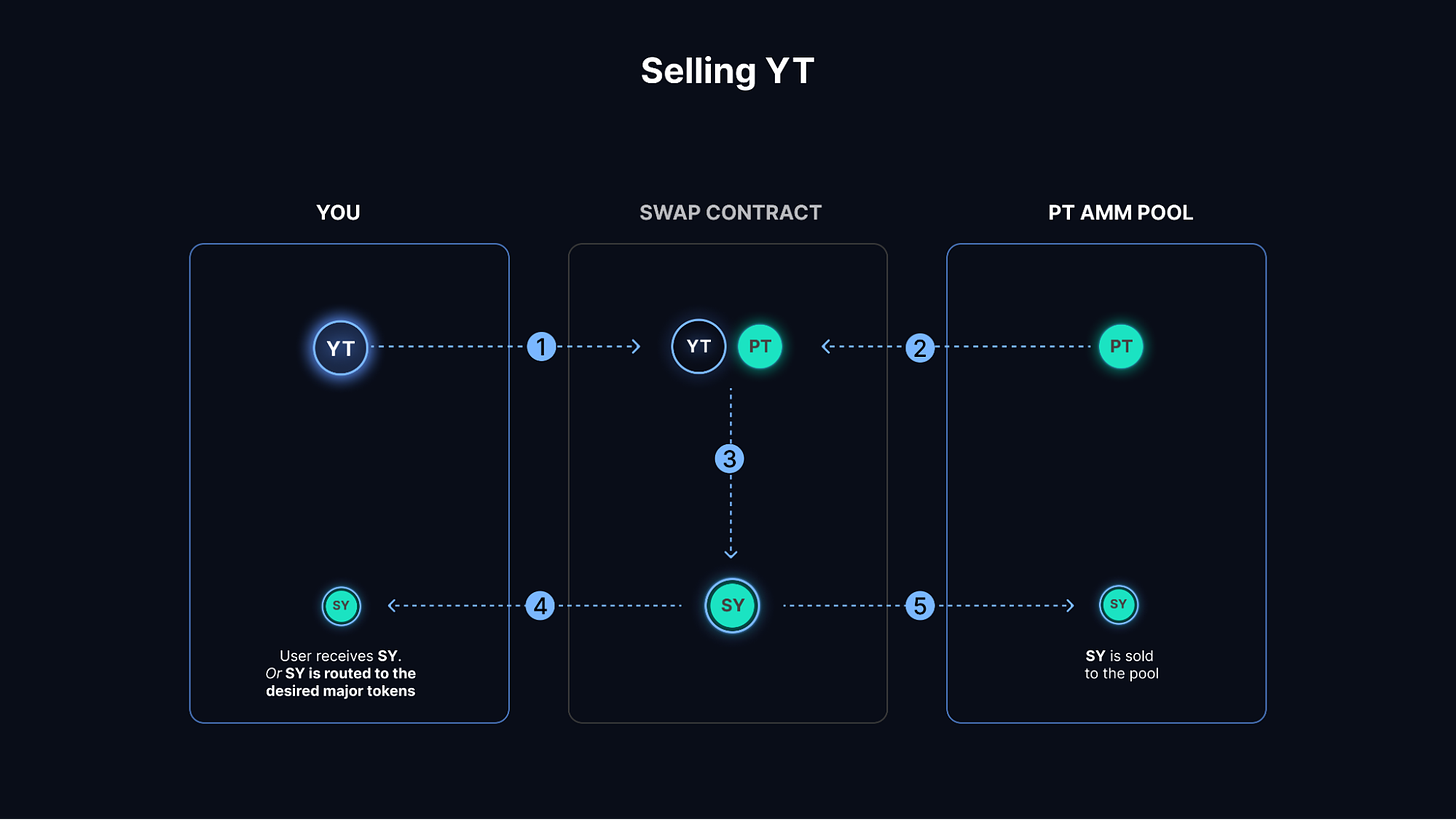

Selling YT

Seller sends YT into the swap contract

Contract borrows an equivalent amount of PT from the pool

The YTs and PTs are used to redeem SY

SY is sent to the seller (or routed to any major tokens, e.g. ETH, USDC, wBTC, etc)

A portion of the SY is sold to the pool for PT to return the amount from step 2

Core Team

The Pendle team has team members who are doxxed and others who remain anonymous but is led by their co-founder and CEO, TN Lee. The team seems to be primarily based out of southeast Asia in countries including Hong Kong, Singapore, and Vietnam.

TN Lee is the CEO of Pendle and remains relatively anonymous with regards to his profile and history but is based out of Hong Kong and Asia. I believe this is his LinkedIn profile which shows a history of being a founding member of Kyber Network and was a consultant for a crypto mining operator in China. You can view his Twitter account here. You can also listen to him speak on a live video AMA hosted by Crypto.com here.

According to an interview conducted by Defi Alliance (DA), Pendle was also co-founded by three other members, GT, YK, and Vu.

Long Vuong Hoang is the Head of Engineering at Pendle and has been working there full-time for two years and five months now, bring promoted from a Smart Contract Engineer to Smart Contract Lead to Head of Engineering. He has experience working at Jump Trading in Singapore as an intern and is relatively young, as he just graduated from the National University of Singapore in 2023. According to his LinkedIn, he began working at Pendle in January 2021, as the protocol would have just been getting started and may be considered one of the founding members, “Vu”.

The remaining founding members of Pendle have no public profile but can be viewed on Discord. GT: GT#4832 YK: Yk#1111

Tokenomics

$PENDLE was announced on April 20, 2021, as Pendle’s native utility and governance ERC-20 token. $PENDLE was launched with a liquidity drop bootstrapping (LDB) event on Balancer that took place on April 28, 2021. The price of $PENDLE started at $0.45 and ended at $1.71 with a total of 4337.87 ETH ($11.83 million) in the liquidity pool. 16.58m $PENDLE tokens were made available for the event.

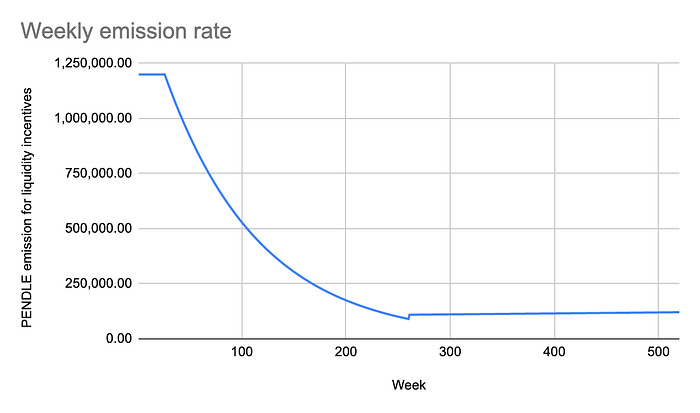

After the LDB event, $PENDLE launched their initial tokenomics model with emissions of 1.2m PENDLE for 26 weeks before decaying by 1% a week until week 260, at which point there will be a terminal inflation rate of 2% per annum based on circulating token supply. See graph below:

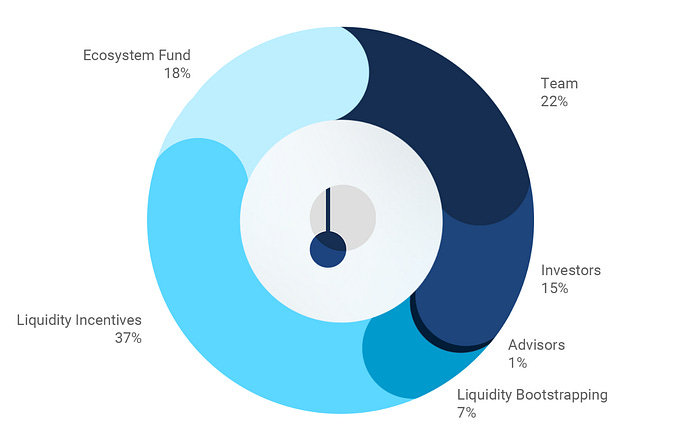

The maximum number of tokens in circulation by the end of year two is 251,061,124. Any subsequent increments would come from liquidity incentives. The following chart shows the breakdown $PENDLE token allocation at the end of year two:

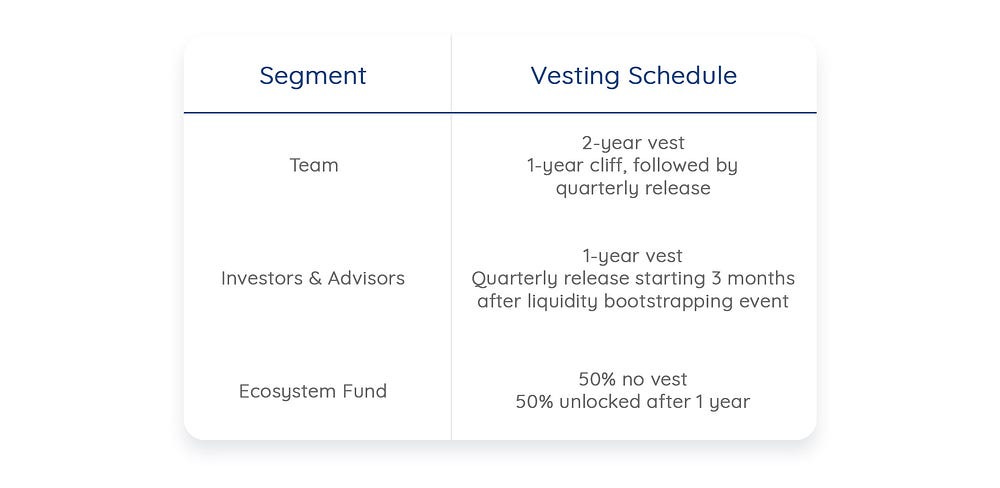

Based on the allocation above, the Pendle team, investors, advisors, and ecosystem fund were each assigned a vesting schedule to align incentives:

After launch, Pendle partnered up with Olympus Pro and announced (Pe,P), a bonding service that allowed Pendle to slowly acquire PENDLE/ETH LP tokens from users and own their own liquidity.

As of October 2022, $PENDLE’s distribution was as follows:

However, during the announcement of Pendle V2 in November 2022, $PENDLE tokenomics were changed up from Olympus Pro’s bonding model to Curve’s vote-escrowed ve(3,3) model. A summary of the new $vePENDLE model:

$vePENDLE grants lockers familiar benefits of Reward Boosting and Incentive Channelling, while Swap Fees will only be received from pools they voted for.

The lock duration ranges from 1 week to 2 years, which gives the locker flexibility on what to optimize for.

As the protocol matures, the alignment of emissions and incentives will result in self-optimization by participants.

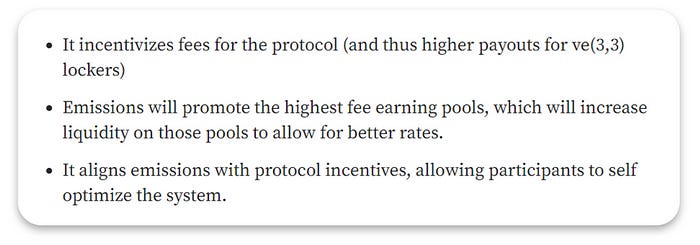

Benefits of the new ve(3,3) model include:

The new vePENDLE model allows users to generate yield by collecting fees and rewards generated by the protocol while simultaneously participating in governance by being able to vote for and direct the flow of rewards to different pools, incentivizing more liquidity for pools they vote for.

vePENDLE Base APY

Pendle collects a 3% fee from all yield accrued by YT. Currently, 100% of this fee is distributed to vePENDLE holders, while the protocol collects no revenue but this is subject to change in the future.

A portion of yield from matured unredeemed PTs will be distributed pro rata to vePENDLE holders as well.

vePENDLE Voter APY

vePENDLE voters are entitled to receive 80% of swap fees generated from voted pools

Pendle also announced on April 27, 2023, that the $vePENDLE token would be receiving an upgrade soon that will improve gas savings on votes and rewards claims and now distribute yield rewards in $ETH versus $USDC.

Risks

Pendle carries various different aspects of risk when considering Pendle as a protocol and $PENDLE as an investment. I think reading @dirty_digs’s blog post about Pendle here is worth a read when considering the various risks of Pendle.

Due to Pendle’s trailblazing and complicated product, users must assume smart contract risk due to all the various steps involved with using Pendle.

$PENDLE has a terminal inflation rate of 2% per annum based on circulating token supply, thus forcing a party to always buy and accumulate tokens or face an overwhelming supply and drop in price.

@dirty_digs highlighted how little financial information is present about Pendle. There is no public information about the team treasury and no fee reporting UI exists.

@dirty_digs mentioned structural risks because the founders are doxxed and located in the US and are therefore liable to US securities laws but I believe this is incorrect, the founder and team seem to be based out of Asia.

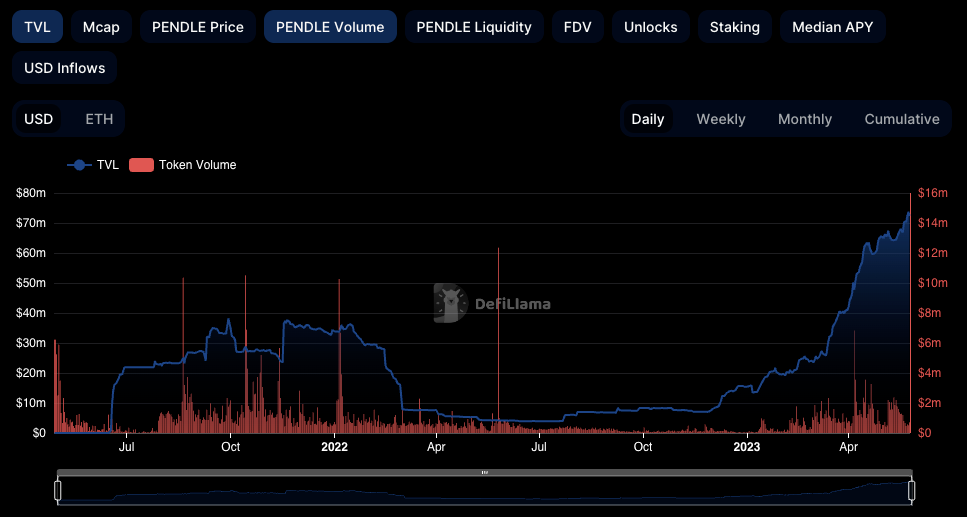

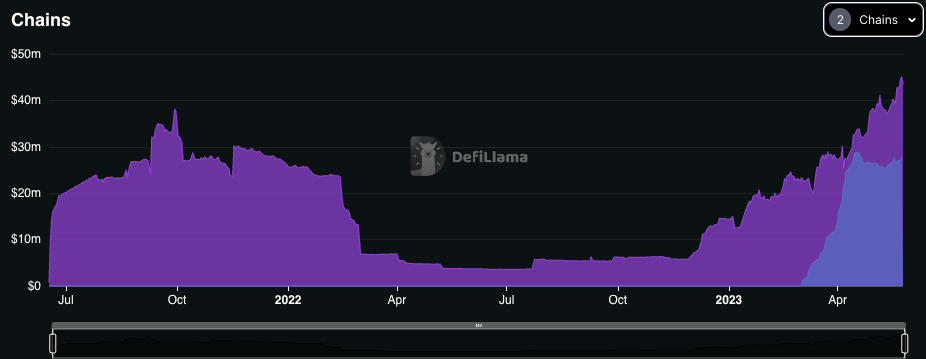

Despite the issues listed above, it is clear that Pendle’s total value locked (TVL) figure has shown consistent growth since its bottom in July 2022 from ~$4m to ~$72m now in May 2023. Pendle’s move to Arbitrum has sparked a large portion of its increase in TVL but it already had positive momentum on Ethereum.

Pendle trading volume has also remained relatively consistent above its lowest figures in H2 2022:

Although this is not clear in the data, I believe that Pendle offers an extremely cool and novel product that may unfortunately be too technically difficult to be utilized properly by retail DeFi traders. It is essentially emulating stripped bonds and an interest rate derivatives market from TradFi, not exactly things most people understand in their day-to-day. As a result, I think Pendle’s products specifically catching on to a broader audience may be difficult.

However, I do think Pendle’s customer acquisition strategy, discussed in their blocmates podcast interview, may work by creating a simpler UI with trading vaults generating yield based on its underlying product. I believe simplifying the protocol, product, and process will greatly increase its popularity and give it a chance to create an environment similar to the interest rates derivatives market seen in TradFi. You can listen to the podcast episode here:

Competition

Pendle is the first mover in bringing stripped bonds and introducing interest rate derivatives to crypto. Therefore, it has a huge advantage over any of its competitors in name and brand, users, and TVL. When simply comparing TVL figures, Pendle’s current ~$72m figure stands miles above its competitors:

Timeless Finance ($LIT): ~$9.2m TVL

Revest Finance ($RVST): ~$1.1m TVL

APwine ($APW): ~$230k TVL

There are few metrics able to be used to be directly compare Pendle with each protocol because they are simply unavailable but simply considering the magnitudes in difference in TVL between protocols paints a clear picture of how much further ahead Pendle is against its competitors.

Concluding Remarks

At its current state and roadmap plan, Pendle is a very interesting protocol to keep an eye on, especially as its TVL figure continues to grow in a consistent manner. However, I think that if it is able to address some of the concerns brought on by the community such as its 2% terminal token inflation rate, its tokenomics, fees, and rewards structure, and its customer acquisition strategy, I think it will be worthy of a protocol worth investing in. If crypto is able to grow into the space that many believe it is capable of, Pendle will be a prime protocol to take advantage of the influx of users and take a massive part in providing the infrastructure for advanced traders to partake in the crypto interest rate derivatives market.

As of now, the Pendle team seems plenty capable of building a stellar product while continuously reevaluating and improving. Pendle V1 was a revolutionary product brought on-chain and Pendle V2 was a significant improvement on top that reflected in its own TVL figures. Furthermore, Pendle having no exploits occurred yet is a testament to its team and their particular nature around smart contract safety despite the complexity of its platform, product, and smart contracts. TN Lee, the CEO, also has a wealth of experience working in the crypto industry along with invaluable experience as a founding member of Kyber Network.

Pendle Finance is a worthy protocol to keep an eye on, especially as it continues developing its products to take over what is already a massive part of the TradFi markets.

To learn more about Pendle, read @dirty_digs blog post here, read chaindebrief’s blog post here, and view Pendle TVL and trading volume statistics here.

I am not a financial advisor. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Excellent report mate ~ thanks for the shout out!